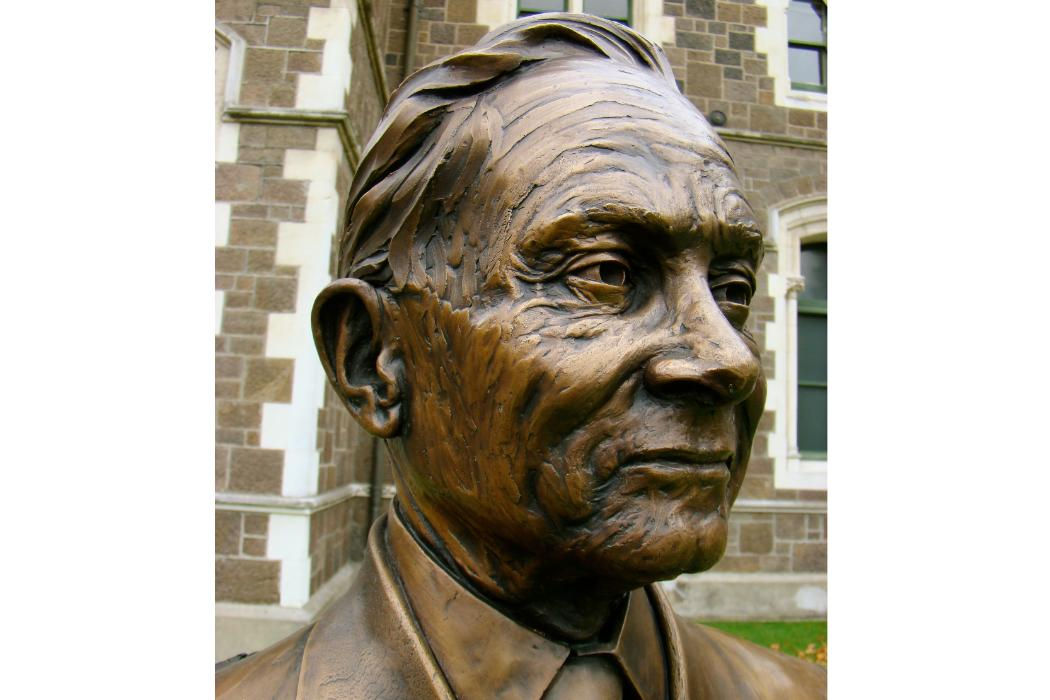

It was the courage, foresight, leadership and sheer hard work of Frank Dickson that saw the Canterbury Savings Bank grow from very modest beginnings to become "the people's bank" of Canterbury, and in its turn create a fund of over $300 million for the Canterbury Community Trust when the bank was eventually sold. Frank Dickson gave 26 years to leading the team that built up that wealth for the people of Canterbury, Nelson and Marlborough.

A far cry indeed from the day a young Aucklander refused to consider a cadetship with the Bank of New Zealand because it would involve transferring around the country and so being away from his beloved yachting on the Waitemata Harbour. Young Frank, his twin brother Roy and younger sister Molly grew up at Northcote, close to the beach. The twins spent their summers sailing, swimming and fishing when not at school, had their first dinghy at age 7, and soon converted its propulsion from oars to sail, with the aid of an old oilskin. Sailing was in their very blood.

Frank's paternal grandfather emigrated in 1902 from Belfast, where he had been a joiner then patternmaker in the shipyards. His mother's father was a keen sailor, later described as "the finest main-sheet hand the Auckland Harbour ever saw". Frank's father Jim combined both these interests, being a joiner who became chief building supervisor for the Ministry of Works in Auckland, and also a fine yachtsman, a great helmsman, and professor of a deep fund of seamanship.

The family was a close and loving one, sharing a strong work ethic, and taking its full part in the close-knit community of Northcote, sharing skills, swapping DIY jobs, socialising. The family hobby was building yachts and then racing and cruising in them. The Dickson boys attended Northcote College, where they were prefects – "competitively close" as ever. If they had an ambition for the future, it was to be professional yachtsmen, a job that did not then exist! Frank's meticulous handling of the takings from the church hall dances suggested that he should go into insurance or banking. So in 1950 he joined the staff of the Auckland Savings Bank. He was 18 years old.

The Auckland Savings Bank had celebrated its centenary in 1947. Tradition was strong and could have been stultifying, but as luck (or talent) would have it, after completing the standard development programme, Frank caught the eye of the manager in charge of new business development and became his assistant. Cold canvassing in the burgeoning area of thrift clubs, the opening of new branches, the advertising and business promotion this involved – these were huge fields of learning and opportunity for him. There followed some years on the lending side, the major area being house mortgages, where he learned about the legal issues of mortgages and the practicalities of lending against bricks and mortar.

A greater vote of confidence came in 1962. By then Frank was back in new business, this time as manager. The long and well-established Auckland Savings Bank (ASB) had agreed to provide guidance and support for the establishment of the proposed Canterbury Savings Bank (CSB). Would Frank go down there for a couple of weeks to help the ASB chief accountant with that job? Leaving Rae with their two children, Frank left for Christchurch the very next day. And the very next day after that, the ASB chief accountant, having alerted Frank to the challenges involved in setting up a community savings bank from scratch, took the afternoon flight back to Auckland, saying: "make it happen!".

This was a challenge which Frank accepted with enthusiasm. Premises had to be found, staff advertised for, systems created from scratch, depositors attracted. Placing the funds, however, was no problem, as the Government guarantee for the new community savings bank required them initially to put 90% of their funds into Government stock and keep 5% in cash – which didn't leave much scope for lending misadventures. Creating this new business was so satisfying that Frank applied for the position of Manager and was appointed.

Further challenges were not wanting. A quality best described as "flexibility" was needed in order to expand the business in the face of detailed prudential rules and supervision from Wellington. In general, the males of Canterbury were wedded to the trading banks and their chequebooks, so the CSB promoted savings to the women and children. Above all, the CSB focused under Frank on building a distinct customer-oriented culture through recruitment of school-leavers and dedication to staff training. With a network of customer-friendly branches and excellent service, the customers of course responded. Once lending got under way and recognition built up, attracting depositors became easier, and the CSB grew and prospered.

26 years of continual growth and success contain too many high points to mention them all.

Some statistics:

Branch growth – 1962 = 1, 1982 = 48, 1988 = 51

Staff – 1962 = 8, 1982 = 480, 1988 = 1000

Depositors' funds – 1962 = $250,000, 1982 = $500m, 1988 = $876m

Figures cannot in any way tell the whole story. Frank's final message to his team, in September 1988, rounded out the picture: "… we felt such an affection for the staff who, to us, were like our family … we have attended weddings, shared the delights of their becoming parents, the sadness of bereavement or the traumas of accident and ill-health with them."

Earlier that year, the President of the Bank, in his Annual Report, said: "In future, the Bank will be run by a Board of Directors and the community trust which has been formed [as the Bank's shareholder] will be the owner of a large, viable and now extremely strong business which has an excellent reputation in its region. The foundation has been well laid and the potential for future benefit to the total community is limitless."

Almost limitless indeed – in the year to 31 March 2008 the Canterbury Community Trust distributed just under $21m in community grants. Its total distributions to that date topped $220m. Thousands of grants have been made, bringing benefits to many thousands of people throughout the region. The initial fund for all that has happened was created by the dedication work of Frank Dickson and his team at the Canterbury Savings Bank.

By Susan Wakefield (Copyright © March 2009 Local Heroes Trust)

Susan Wakefield is a former chartered accountant who chaired the Commerce Commission 1989–94. She has been chairman of the Local Heroes Trust since its inception.