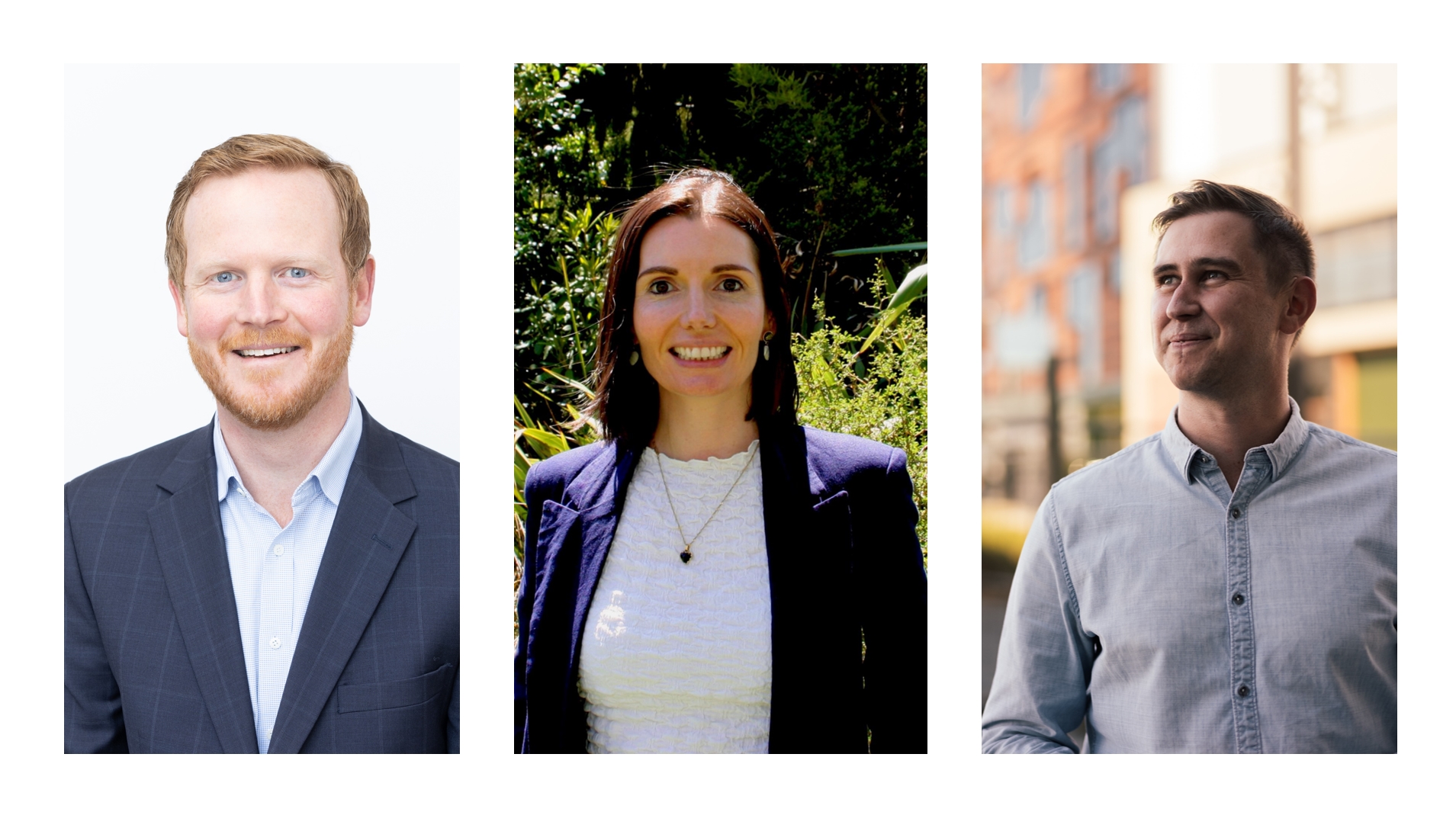

(left to right) Professor Jedrzej Bialkowski (Head of Department Economics and Finance), Jaden Fearon (3rd place winner), Luc Mackay (Challenge winner), Harry Bird (3rd place winner) and Dr Moritz Wagner.

Hosted in association with the UC Investment Society and UC Business School, the annual competition gives students an opportunity to put their investment strategies to practice with a range of financial derivative instruments, including cryptocurrencies, gold and silver commodities, forex and shares via the CMC Markets online trading platform.

This year over 200 teams, comprising of individuals or pairs, battled it out in real-world financial markets. Over four weeks, the contestants used a virtual fund of $250,000 to test their knowledge and trade for the best returns.

MacKay shot to the top spot during the final days of trading using a high-risk strategy.

MacKay says, “The contest seemed like a great opportunity to expand my trading knowledge. I didn’t expect to win because others were taking a much more aggressive approach. Surprisingly, I wasn’t even on the leader board two days before the competition ended.

“I started off trading the Hong Kong 50 as it had decent leverage, allowing me to use the constant movement of the market to my advantage. After a couple of weeks I decided to fry some bigger fish and moved over to the US indices.

“Originally, I had no intention of winning, but once I got to grips with the best strategies, I let loose. Overall, the CMC platform was very easy to navigate and it taught me how to take losses to make profits without letting emotions influence my trading,” he adds.

Another new participant, first-year Commerce student Paul Kaiser, collected second place with an ROI of 224.39%.

Kaiser says, “I felt a bit intimidated taking part since I’ve never held stocks short-term or anywhere near as much as $250,000. Initially I started out with crypto but due to its higher volatility and margin requirements, I changed tact. My refined game plan was going long on major index funds in developed countries such as the NASDAQ 100, with commodities such as crude oil mixed in.

“This competition really gave me a new appreciation for market forces and the risks involved, particularly in the last few days of the competition where my account halved in value. Using the CMC Markets platform was a huge step up from simpler ones like Sharesies - where they are missing useful tools like live charts and price updates, this platform gave me more freedom while trading.”

In third place were returning team, second-year Engineering and Economics students, Jaden Fearon and Harry Bird who made informed, balanced investments.

Fearon says, “Although this was our second year participating, we managed to end up in the exact same position! For most of the competition we were in 1st place and reached a high portfolio value of $3.6 million. However, our rapid gains also turned to rapid losses near the end of the contest and we lost almost $3 million of that.

“Our game plan was to invest in low-risk commodities such as the S&P 500 but make the most of the leverage we could achieve. This taught us that leveraging can be a very high-risk, high-reward trading style. We found that the CMC platform’s interactive charts and live prices made choosing what to invest in much easier, as we had all the knowledge needed to make informed decisions,” he concludes.

Chris Smith, General Manager at CMC Markets New Zealand, says, “Share trading continues to become more accessible to Kiwis, driven by fintech apps and zero trading fees. We’re pleased to see this growing interest and engagement in trading across all ages, which is demonstrated by the record number of students participating in this competition.

“This year’s contestants had the added challenge of competing in a global market still impeded by the Covid-19 pandemic. We also saw large fluctuations in the market driven by volatility in cryptocurrencies. The contestants were able to experience real trading in the global markets, all while fuelled by some healthy competition.”

Dr Moritz Wagner, University of Canterbury Finance Lecturer says, “In recent times, we have seen extreme market turmoil and the gamification of investing via commission-free fintech apps. The annual trading competition provides students with an opportunity to apply their theoretical knowledge and develop further insights across a wide range of financial products. In this safe environment, they can gain important skills for building successful careers.”

.jpg)