One choice the government has is to take less in taxes from the population of New Zealand, which means individuals, rather than the government get to choose what that money is spent on. People often disagree on what level of tax is “right and fair” – we get a say in that every three years at an election – but the level of tax take is a government choice.

Another choice is whether to spend money now or later. Similar to the way households face the choice between spending now or paying a little more off the mortgage and being able to spend later so does the government. Therefore another choice is debt repayment or, if there is a deficit, less debt. Debt taken on now will have to be repaid by future taxpayers. Reasonable people will also disagree on what level of debt is OK.

At some point the government will decide on both, taxes it will collect and a comfortable level of debt – then the task is what gets funded.

A high priority should be given to areas where there are wider public benefits. Economists call these things ‘externalities’. A good example is vaccination. When you get vaccinated you are protected (a private benefit) but there are spill-over benefits to others who are also protected as you contribute to herd immunity making the spread of disease less likely in the community. If people had to pay for the vaccine then they are likely to think mostly about the benefits to themselves rather than others and so potentially not enough people would get vaccinated.

First-year fees-free tertiary education fails this test. The benefits of this policy largely go to students in the form of higher lifetime incomes and most tertiary students are from middle and upper income households already. Many activities will be dressed up as providing wider benefits when they really do not. Government spending on the America’s Cup races and Hollywood movie subsidies is likely to be low value per dollar and provide mostly private benefits. So ask – what do others (who aren't being directly funded) get out of this? And are those benefits taxpayers should be paying for anyway?

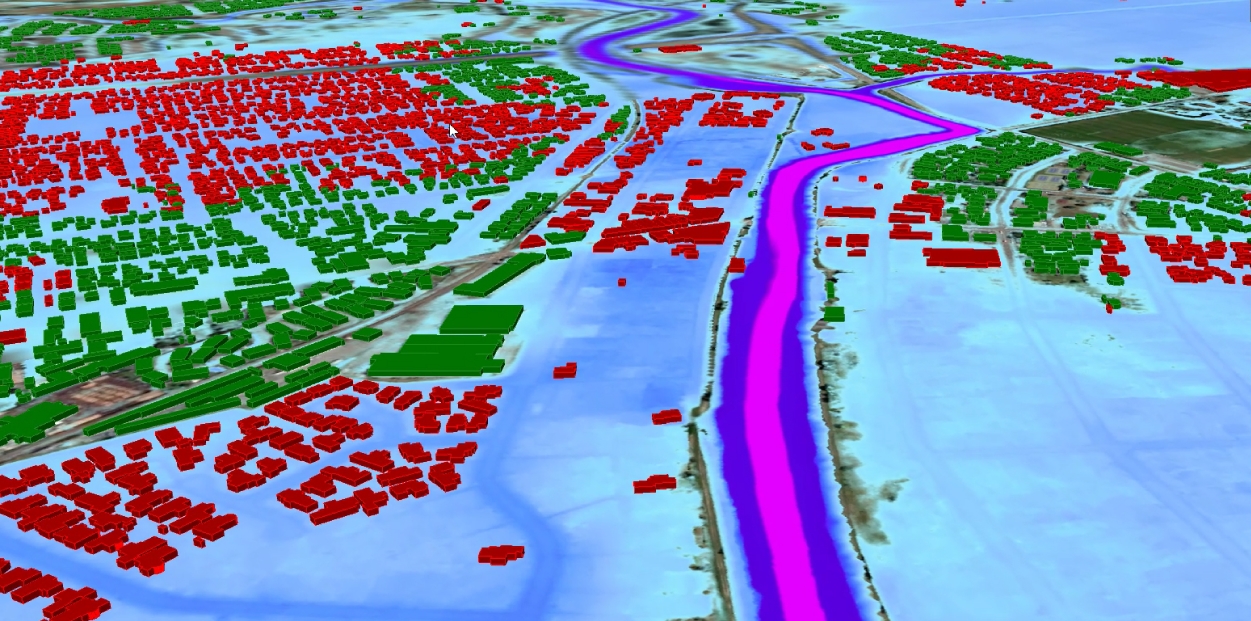

The government would also do well to focus on expenditure that brings long term benefits to New Zealanders. Expenditure on children that improves long term outcomes is likely to be a better investment than expenditure on those who have fewer years to run. That will sound harsh to some, but remember opportunity cost always bites and we can't have more of everything. Similarly, expenditure on infrastructure has long term benefits for all of New Zealand whether it is fibre to homes, roads or new hospitals. These projects should not be assessed on the basis of how many jobs their construction creates. That's short term and estimates of how many jobs are actually created routinely falls below what was forecast. Further, workers used to build hospitals can't be used to build houses. Focus on the long term.

The government should also be willing to ask – what should we stop doing? This can be a problem as every programme that's currently happening is a special case to someone and they'll fight for it. But existing items of expenditure should also have to compete with new ones.

Complicating this is that all governments have an eye on getting re-elected. That means they need to keep their supporters happy (all politicians give money to their mates, it's just that they have different mates). Unfortunately this leads to some low quality expenditure – think Shane Jones and the Provincial Growth Fund. As a general principle the less of that sort of expenditure we have the better off we all are.

Minister of Finance Grant Robertson has a tricky job. But as New Zealanders who care about what government delivers we should pay some attention to how he goes about making budget decisions.

Stephen Hickson is the Director of the Business Taught Masters programme and teaches Economics at the University of Canterbury.